MEDICARE

You don’t have to figure it out alone.

This page is designed to give you a clear understanding of Medicare and help you feel confident about your decisions.

Contact Us Today

To Request a Consultation

Patricia Lewis

Speak With Patricia

Shop For Insurance

Rx Drug Lookup Form

What is Medicare?

Medicare is a federal health insurance program for:

• People age 65 and older

• Individuals under 65 with certain disabilities

• People with Chronic, Kidney Disease, End-Stage Renal Disease (ESRD) or ALS

Medicare helps cover hospital care, doctor visits, prescriptions, and preventive services, but it does not cover everything. That’s why understanding your options is so important.

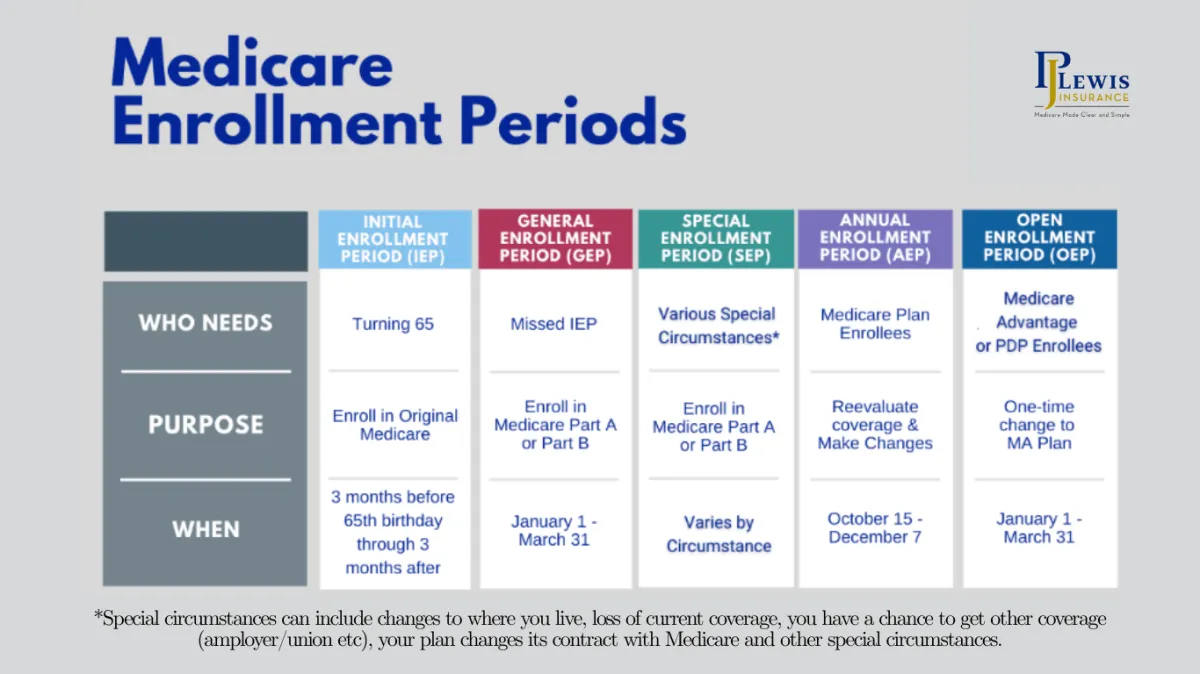

When Does Medicare Start?

For most people, Medicare begins around their 65th birthday.

Your Initial Enrollment Period is a 7-month window:

• Begins 3 months before your 65th birthday month

• Includes your birthday month

• Ends 3 months after your birthday month

If you enroll before your birthday month, coverage typically starts the first day of your birthday month. Enrolling later may cause your coverage to start at a later date.

Some people may delay Medicare if they are still working and have employer health coverage. In these situations, special rules apply, and it’s important to understand how timing affects coverage.

What Are The Types of Medicare?

Medicare is made up of four main parts, and each part covers different healthcare needs. Understanding these types helps you choose coverage that fits your health, lifestyle, and budget.

1. Original Medicare (Part A & Part B)

Original Medicare is provided directly by the federal government and forms the foundation of Medicare coverage.

Medicare Part A (Hospital Coverage)

Helps cover:

• Inpatient hospital stays

• Skilled nursing facility care (after a hospital stay)

• Hospice care

• Limited home health services

• Most people do not pay a monthly premium for Part A if they worked and paid Medicare taxes.

Medicare Part B (Medical Coverage)

Helps cover:

• Doctor and specialist visits

• Outpatient services

• Preventive care (screenings, lab tests)

• Medical equipment like walkers or oxygen

Part B requires a monthly premium and usually includes copays or coinsurance.

✔ You may see any doctor or hospital that accepts Medicare

❌ Does not include prescription drugs or routine dental, vision, and hearing care

❌ No yearly out-of-pocket limit

2. Medicare Supplement (Medigap)

Medicare Supplement plans work with Original Medicare to help pay costs that Medicare does not fully cover.

These plans may help with:

• Deductibles

• Copayments

• Coinsurance

Medigap plans offer:

• Predictable healthcare costs

• Nationwide coverage

• No provider networks or referrals

Part B requires a monthly premium and usually includes copays or coinsurance.

❗ Medigap plans do not include prescription drug coverage and are often paired with a Part D plan.

3. Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans replace Original Medicare while still providing Medicare-approved coverage.

Many Medicare Advantage plans include:

• Hospital and medical coverage

• Prescription drug coverage

• Dental, vision, and hearing benefits

• Additional services such as fitness or transportation

These plans typically:

• Use provider networks (HMO or PPO)

• Have copayments for services

• Include an annual out-of-pocket maximum

4. Medicare Part D (Prescription Drug Coverage)

Medicare Part D helps cover the cost of prescription medications.

Plans vary by:

• Monthly premium

• Covered medications (drug list)

• Pharmacy network

Choosing the right Part D plan can significantly reduce prescription costs over the year.

These plans typically:

• Use provider networks (HMO or PPO)

• Have copayments for services

• Include an annual out-of-pocket maximum

You choose between Original Medicare and Medicare Advantage when you first become eligible for Medicare. If you want to change to the other type of Medicare, you can do so during the annual open enrollment period.

There Is No Cost For Our Services

Request a No Cost Consultation Today!

We offer a range of services designed to provide you with complete health coverage. Whether you're looking for basic health insurance or advanced care options, our services are tailored to protect you and your loved ones in every stage of life. With us, you can rest easy knowing that your health is in good hands.

Medicare

Advantage Plan

Medicare

Supplement Insurance Plan

Medicare

Part D Prescription Drug Plans

Want a Medicare E-Book Guide?

Medicare can feel complicated but it doesn’t have to.

This guide breaks it down step by step so you can make confident choices for 2026 and beyond.

All Rights Reserved - PJ Lewis Insurance

We do not offer every plan available in your area. Currently, we represent 8 organizations which offer 75 products in your area. Please contact Medicare.gov, 1-800- MEDICARE, or your local State Health Insurance Assistance Program (SHIP) to get information on all of your options. This is a proprietary website and is not associated, endorsed or authorized by the Social Security Administration, the Department of Health and Human Services or the Center for Medicare and Medicaid Services.

This site contains decision-support content and information about Medicare, services related to Medicare and services for people with Medicare. If you would like to find more information about the Medicare program please visit the Official U.S. Government Site for People with Medicare located at

http://www.medicare.gov